A New Era for Cross-Border Payments

The world of international banking has evolved dramatically over the last decade, with innovations such as the virtual International Bank Account Number (virtual IBAN or vIBAN) creating new opportunities for businesses around the world. This unique solution offers significant benefits, including reduced costs for cross-border payments, simplified payment reconciliation, and improved efficiency of back-office operations.

Virtual IBANs have emerged as powerful tools for businesses, especially those operating in high-risk industries. In this article, we aim to demystify the concept of the vIBAN and illustrate how it can enhance your business operations on a global scale.

What are Virtual IBANs?

A virtual IBAN, or vIBAN, is a reference number provided by a banking or payments institution to facilitate local payments virtually. It mirrors the structure of a traditional International Bank Account Number (IBAN) but carries its own unique features and benefits. For high-risk businesses, which typically grapple with complexities around large payment volumes and regulatory challenges, virtual IBANs can significantly simplify their financial operations.

A standard IBAN is matched directly with a bank account. However, with a virtual IBAN, you can generate multiple unique vIBANs associated with a single pooled account. These act as sub-accounts linked to a master account, facilitating effortless payment routing and reconciliation.

As a high-risk business, using virtual IBANs can clarify the origin of each payment, reducing the need for additional reference information, thereby saving time and enhancing the accuracy of payment reconciliation. By assigning a unique virtual IBAN to each payee, businesses can quickly identify the source of each payment, thus reducing errors and delays associated with manual payment reconciliation.

Anatomy of a Virtual IBAN

The International Bank Account Number (IBAN) is a unique alphanumeric code assigned to each bank account for seamless international transactions. It includes essential details about the bank account owner. While there is no standardized length for IBANs across SEPA countries, they generally should not exceed 34 characters. However, each country often has its own specific fixed length for IBANs

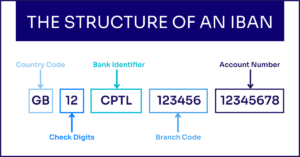

To appreciate the value of virtual IBANs, it’s essential to understand the mechanics of a regular IBAN.

Though the string of characters in a virtual IBAN might seem complex, each element carries essential information. Here’s an illustrative breakdown:

- Country Code (First two letters): This indicates the country where the account is held.

- Check Digit Code (Two digits): This validates the IBAN before a transaction is made.

- Bank Identifier Code (Next four letters): This represents the issuing bank.

- Branch Code (or Sort Code) and Account Number: This identifies the specific account. The length depends on the issuing country’s norms.

Virtual IBANs and Traditional Banking Instruments

It’s important to differentiate between virtual IBANs and traditional banking identifiers such as sort codes, account numbers, and SWIFT codes. While the first two are used mainly for domestic payments, SWIFT codes and IBANs ensure the correct routing of international transactions.

How Virtual IBANs Boost Business Efficiency

Businesses that handle a large volume of payments can greatly benefit from virtual IBANs. They provide an efficient infrastructure for segregating operational funds from customer transactions, thereby streamlining the reconciliation process.

Crypto exchanges exemplify this advantage. By issuing virtual IBANs, each client’s incoming payment is directed to a named virtual account. This feature eliminates the need for additional reference information, making it clearer and quicker to manage transactions.

Virtual IBANs and Embedded Finance

Embedded finance integrates financial services into other business ecosystems via APIs. This opens up a whole new world of possibilities for high-risk businesses to integrate banking and payment services that cater to their specific needs.

Virtual IBANs are one of the financial services that can be integrated via APIs, offering businesses the chance to build unique financial products, services, and processes. By partnering with embedded finance providers, high-risk businesses can bundle services like virtual IBANs with multi-currency functionality, enabling them to consolidate their financial operations.

Getting Started with Virtual IBANs

Virtual IBANs offer a solution to numerous challenges faced by businesses dealing with international transactions. As they become more prevalent in the world of cross-border payments, early adopters stand to gain a competitive edge. By understanding their utility and implementing them effectively, businesses can streamline their operations and improve efficiency. Adopting this innovative financial tool ensures your high-risk business stays ahead of the curve.

While vIBANs are set to become the standard model for accepting cross-border payments, it’s crucial to select a provider that offers scalability, fast setup, and smart reconciliation features. Capitalixe connects you with trusted providers that empower high-risk businesses to design bespoke account and payment solutions, ensuring they have all the financial tools they need to thrive.

Looking for unlimited virtual IBANs that can be generated within hours through a single API integration? Get in touch with our team of consultants to know how!