Have you noticed how in today’s interconnected world, conducting international transactions is becoming more common? If you’ve dipped your toes into this global economy, you’ve probably come across terms like SWIFT and BIC codes. But what exactly are they, and how do they make the world go round in the realm of international finance?

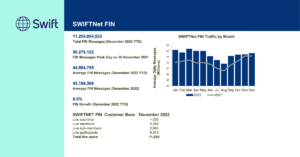

Let’s talk about SWIFT – the Society for Worldwide Interbank Financial Telecommunications. Founded in 1973, this member-owned cooperative began simplifying the way money moves across borders. Today, SWIFT connects over +11.5K financial institutions across +200 countries and territories, handling +44 million messages daily.

In this complete guide, we’re going to give you the lowdown on all things SWIFT codes. We’ll break down what SWIFT codes are, how they work, and why they’re great for smooth cross-border transactions. Whether you’re a seasoned international business owner or someone who’s just starting to explore global markets, we’ve got you covered. Let’s get started!

What is a SWIFT code?

SWIFT codes (also known as BIC codes) play an important role in ensuring safe and speedy international payments through the SWIFT system. When you’re carrying out overseas transactions, a SWIFT code acts as a sort of digital fingerprint, verifying the identity of the banks or financial institutions that are involved. This security measure helps to guarantee that funds are being directed to the correct account.

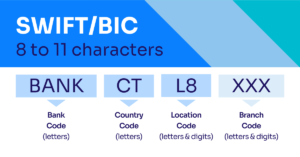

Typically, SWIFT codes are between 8 and 11 characters long, with each character holding specific information that can be validated. This could be the bank, country of origin, or branch location. Once the bank’s identity is authenticated through the SWIFT code, it paves the way for a quick and secure transfer of funds across borders.

Now, let’s clarify a common source of confusion: the difference between SWIFT and BIC codes. Essentially, SWIFT is the name of the messaging system itself, while BIC refers to the Bank Identifier Code used within that system. However, these terms are often used interchangeably to refer to the code or even the entire system. So, whether you ask for your SWIFT or BIC code, you’ll receive the same 8-11 digit number.

SWIFT Services

The SWIFT system offers a number of helpful services to make business transactions smooth and accurate. Here’s a breakdown:

- Applications: With SWIFT connections, you can access different apps for various needs. These include real-time instruction matching for treasury and forex transactions, banking market infrastructure for processing payment instructions between banks, and securities market infrastructure for handling clearing and settlement instructions for payments, securities, forex, and derivatives transactions.

- Business Intelligence: SWIFT now has dashboards and reporting tools that give you up-to-date insights into your messages, activity, and trades. You can filter them by region, country, or message type to get the info you need.

- Compliance Services: For staying on top of rules against financial crime and cross-border payment fraud, SWIFT offers reporting and utilities for Know Your Customer (KYC), sanctions screening, and anti-money laundering (AML) purposes. These compliance services help businesses stay on top of regulatory requirements and ensure the integrity of their transactions.

Who Uses SWIFT?

When it first came out, SWIFT was created to streamline communication specifically for Treasury and correspondent transactions. But thanks to its flexible design, it quickly grew to serve a wide range of users, including:

- Banks

- Trading houses and brokerage institutes

- Securities dealers

- Clearinghouses

- Depositories

- Corporate businesses

- Businesses and individuals making money transfers or international wires

- Money and foreign brokers

Do You Need a SWIFT Code to Make International Payments?

If you’re sending or receiving money from abroad through your business bank account, chances are you’ll need the recipient’s SWIFT code. Think of it as the digital address that makes sure your money reaches the right place securely. Without this code, your transaction could hit challenges and may not go through smoothly.

Alongside the SWIFT code, you’ll likely also be asked for an IBAN (International Bank Account Number) when making international transfers. In our next section we’ll explain a bit more about what they are, and how they differ from SWIFT codes.

IBAN vs SWIFT code

A SWIFT code is used to pinpoint a specific bank, while your IBAN identifies your individual bank account for international transfers. Think of your IBAN as a global bank account number designed to simplify international transactions.

Your IBAN starts with a two-letter country code in uppercase, followed by two numbers, and can be up to 34 characters long. It provides extra details, such as the destination country, which are crucial for identifying overseas payments, especially for wire transfers to European countries. So, while a SWIFT code directs funds to the right bank, your IBAN ensures they reach the correct account within that bank.

How are SWIFT Codes Formatted?

Your SWIFT code, made up of both numbers and letters, consists of 8 characters (or possibly 11 if it includes the branch location).

The first 4 letters of the code represent the financial institution unique to your banking service provider. To simplify, these letters often correspond to the initials of your bank’s name.

After this, there’s a 2-letter country code, such as ‘FR’ for France or ‘DE’ for Germany, and a 2-character location code indicating the bank’s headquarters.

If provided, the last 3 digits refer to the specific branch associated with your bank account.

How to Find a SWIFT Code?

Finding a SWIFT code might seem a bit daunting if you’re coming across them for the first time, but it’s actually quite straightforward.

Here’s how you can do it:

Check your Bank’s Website: Lots of banks list their SWIFT codes on their websites, especially if they carry out international transactions. Look for a section dedicated to international banking, or simply use the search bar to find the information you need.

Contact your Bank Directly: If you can’t find the SWIFT code online, then you can always reach out to your bank directly. Contact them via phone, email, or even visit a branch in person. They’ll be more than happy to provide you with the necessary details.

Check your Bank Statement: Sometimes, your SWIFT code may already be listed on your bank statement, especially if you’ve previously made international transactions. Take a look at your recent statements to see if the code is included.

Ask the Recipient: If you’re receiving funds from abroad, you can always ask the sender for the SWIFT code of their bank. They should be able to provide you with this information to guarantee that the transaction goes smoothly.

By following these steps, you’ll be able to easily find the SWIFT code you need to make your international transactions.

Streamlining your International Payment Processes

So, there you have it—our complete guide on SWIFT codes! Now you’re equipped with the know-how to tackle international transactions like a pro.

Remember, SWIFT codes can help your business unlock straightforward cross-border payments, whether you’re sending money to family overseas or conducting business on a global scale. And, with services like Capitalixe by your side, managing your international finances has never been easier.

With access to a wide range of payment channels, including SWIFT for global transfers and local options like SEPA, UK, FasterPayments, and ACH, our payment and banking solutions ensure seamless transactions wherever your business operates.

Our extensive network and industry expertise have earned us a reputation as one of the most trusted names in alternative banking. But that’s just the beginning. We boast over 50 global partners, offering you unparalleled connectivity and support. With 25+ years of combined experience, our team is equipped to handle your financial needs with precision and reliability.

Join our community of over 100 institutional clients worldwide who rely on us for their international payment solutions. Contact us today!