CBD: A Market on High Rise

The surge in popularity of Cannabidiol-based products is undeniable, with an increasing adoption rate across various industries such as beauty, health, and even pet care. This rise in demand is largely attributed to a shift in consumer perceptions towards products derived from cannabis, coupled with the diverse applications and consumption methods these products offer.

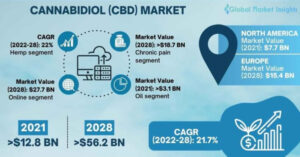

The global cannabidiol (CBD) market, valued at USD 6.4 billion in 2022, is expected to grow at a compound annual growth rate (CAGR) of 16.2% from 2023 to 2030. This growth is primarily driven by the increasing interest in the potential health benefits of CBD, leading to increased investment in research and development. The market is also expected to grow with the increasing legalization of hemp-based products.

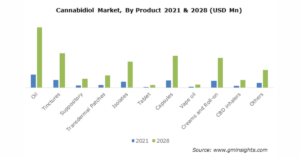

In terms of sales type, the B2B segment dominated the market and accounted for a revenue share of 54.7% in 2022. The segment is expected to see substantial growth over the forecast period due to a rise in the number of wholesalers offering CBD oil and the growing demand for CBD oil as a raw material. By product, CBD oil alone accounted for over USD 3.1 billion revenue in 2021. The oil is commonly used in pain-related disorders due to its extensive benefits. The chronic pain segment is expected to surpass USD 18.7 billion by 2028 due to the increasing demand for CBD in the treatment of chronic pain.

In the B2B end-use, the pharmaceuticals segment accounted for a revenue share of over 73.5% in 2022. The segment is expected to see substantial growth over the forecast period due to the growing number of clinical trials to assess the effects of CBD on various health conditions.

While the CBD industry continues to gain traction and recognition for its potential health benefits, businesses operating in this sector often face unique challenges when it comes to securing reliable and efficient payment solutions. Due to the perceived risks associated with the cannabis industry, CBD businesses are considered high-risk by traditional financial institutions.

What is a CBD Merchant Account?

A merchant account serves as the foundation for businesses to accept credit and debit card payments. For CBD businesses, having a reliable and secure payment solution is vital to ensure seamless transactions, customer trust, and business growth. However, obtaining a merchant account in the CBD industry can be a complex process due to the industry’s association with the cannabis sector.

Challenges Faced by CBD Businesses

CBD businesses grapple with challenges that significantly shape their operational landscape and profitability:

Regulatory Landscape

CBD businesses operate in a regulatory grey area, with varying laws and regulations across different jurisdictions. This inconsistency poses challenges in obtaining banking services, as financial institutions often lack clarity on the legal status of CBD products.

High-Risk Perception

CBD merchant accounts are globally considered high-risk due to varying international laws, regulatory uncertainty, strict financial regulations, potential reputational damage, high chargeback rates, and concerns over product quality and safety. These factors discourage traditional financial institutions from servicing CBD businesses.

Limited Options

Many traditional financial institutions are hesitant to provide merchant accounts to CBD businesses, leading to a scarcity of viable payment solutions. This scarcity often results in higher fees, longer settlement periods, and restrictive terms and conditions.

Given these risks, many banks and traditional financial institutions shy away from providing merchant services to CBD businesses, labeling them as “high risk.” This has led to the development of specialised high-risk merchant service providers who are willing to service the industry, often at higher costs.

CBD Payment Processing Solutions

Specialised merchant account providers cater specifically to high-risk industries like CBD. These providers have the expertise and experience to navigate the unique challenges faced by CBD businesses, offering tailored solutions to meet their specific needs. By partnering with such providers, CBD businesses can gain access to reliable payment processing services, including credit and debit card transactions. High-Risk merchant account providers are designed to handle a high volume of transactions without triggering fraud alerts which is particularly useful during peak sales periods or when businesses grow rapidly. Also, they offer multi-currency processing, a feature that enables high-risk businesses to operate internationally.

High-risk merchant accounts can provide CBD businesses with a range of payments and banking solutions tailored to their specific needs:

Credit and Debit Card Processing

This is a fundamental service provided by high-risk merchant accounts that allows businesses to accept payments made using credit and debit cards. These accounts can often process a wide variety of card brands including major ones like Visa, MasterCard, American Express, and Discover. They use secure encryption methods to protect sensitive card information during transactions.

Secure Transactions

The security of financial transactions is crucial. High-risk merchant accounts employ advanced encryption technologies, tokenization, and secure gateways to protect transaction data from cyber threats. This helps ensure that sensitive information like card numbers, customer names, and CVVs are kept safe.

Payment Gateway Integration

A payment gateway is an e-commerce service that authorises and processes credit card payments for online and offline businesses. They ensure the secure transfer of transaction data from the payment portal (like a website or mobile app) to the acquiring bank. Integrating with a payment gateway allows CBD businesses to accept online payments efficiently.

ACH Processing

Automated Clearing House (ACH) transfers enable electronic funds transfers between bank accounts. CBD businesses can leverage ACH transfers to receive payments directly from customers’ bank accounts. ACH transfers offer a convenient and cost-effective alternative to credit card payments.

High Volume Processing

This feature is crucial for businesses that experience large transaction volumes or sudden spikes in sales. High-risk merchant accounts are designed to handle these scenarios without triggering account holds, freezes, or terminations that might occur with standard merchant accounts.

Multi-Currency Processing

This feature allows businesses to accept payments in multiple currencies, which is critical for businesses operating in the global market. It also typically includes currency conversion features, so businesses can accept foreign currencies and have them converted into their home currency.

Recurring Billing

This feature automates the billing process for businesses that offer subscription-based services or products. It allows businesses to automatically charge a customer’s account at pre-determined intervals, providing a convenient payment experience for the customer and steady, predictable revenue for the business.

Mobile Payments

This feature allows businesses to accept payments made via smartphones or tablets. As mobile shopping continues to grow, the ability to accept mobile payments can greatly increase a business’s reach and convenience.

POS Systems

Point of Sale (POS) systems are the hardware and software that allow businesses to accept in-person card transactions. These systems can include cash registers, card readers, and barcode scanners. High-risk merchant accounts may offer specialised POS systems designed to meet the unique needs of high-risk businesses.

Chargeback Management

Chargebacks can be costly for businesses. High-risk merchant accounts often include features to help businesses manage, dispute, and reduce chargebacks. These may include detailed transaction reports, alerts for suspicious activity, and support in the dispute process.

Fraud Prevention Tools

Fraud can be a significant issue for high-risk businesses. Fraud prevention tools provided by high-risk merchant accounts may include Address Verification Service (AVS), Card Verification Value (CVV) checks, geolocation tracking, IP address monitoring, and machine learning algorithms to identify and prevent potential fraudulent transactions.

Reporting and Analytics

These features allow businesses to track and analyse their sales, customer behavior, and other key business metrics. These insights can inform decision-making and help businesses optimise their operations and marketing strategies.

Customer Support

Many high-risk merchant service providers offer dedicated customer support to help businesses resolve any issues they may encounter. This support can be especially valuable for high-risk businesses that may face unique challenges or have specialised needs.

eCheck Processing

Electronic checks, or e-checks, provide CBD businesses with a digital payment method that replicates traditional paper checks. E-checks allow customers to provide their bank account and routing information to make payments. This method can be particularly useful for customers who prefer not to use credit cards or are unable to do so.

Virtual Terminal

A virtual terminal is an online tool that allows businesses to process card-not-present transactions. This means that businesses can enter a customer’s card details manually, allowing them to accept payments over the phone, through mail orders, or via fax. This is especially useful for businesses that do not sell products or services directly through an online platform or physical store.

Alternative Payment Options for CBD

The CBD industry is growing at a rapid pace, and with this growth comes a need for financial services that understand and cater to this unique sector.

In the face of hesitation from traditional financial institutions, CBD businesses are finding innovative financial solutions to meet their needs. The complex legal and regulatory landscape surrounding cannabis-related products often deters banks from partnering with these businesses. However, CBD companies are turning to alternative payment options that help them navigate the financial landscape and cater to the demands of their clientele effectively.

Cryptocurrency Payments

Accepting cryptocurrency payments, such as Bitcoin, can offer CBD businesses an additional payment option. Cryptocurrencies provide secure and decentralised transactions, reducing the risk of chargebacks and fraud. By integrating cryptocurrency payment processors, CBD businesses can enable customers to make purchases using digital currencies.

Offshore Merchant Accounts

CBD businesses facing significant challenges in securing domestic merchant accounts may explore offshore options. Offshore merchant accounts operate in jurisdictions where CBD regulations are more lenient or well-established. These accounts can provide more flexibility in terms of payment processing, but careful consideration of regulatory compliance is essential.

Payment Facilitators

Also known as payment aggregators, payment facilitators offer a streamlined onboarding process for CBD businesses. They act as intermediaries between businesses and financial institutions, simplifying the merchant account application process. Payment facilitators often cater to high-risk industries and can provide quick access to payment processing solutions.

Choosing a CBD Merchant Account Provider

Selecting the right merchant account provider for your CBD business is a pivotal decision that can significantly impact your operations and profitability. Industries deemed “high-risk”, due to their inherent risk factors, often encounter difficulties in finding suitable merchant account providers that understand and cater to their specific needs. Navigating the landscape of high-risk merchant account providers requires careful consideration and informed decision-making to strike the delicate balance between risk management, cost-effectiveness, and customer experience.

Compliance Expertise

CBD businesses must partner with a merchant account provider well-versed in the legal and regulatory frameworks governing the industry. This ensures compliance with local and international laws, reducing the risk of account termination or financial penalties.

Security Measures

Protecting sensitive customer information is paramount in any payment transaction. CBD businesses should prioritise merchant account providers that offer robust security measures, such as encryption, tokenization, and fraud detection systems.

Competitive Fees and Rates

While high-risk industries often face higher processing fees, CBD businesses should compare rates and fees among different merchant account providers to ensure competitive pricing without compromising on service quality.

Securing the Success of CBD Businesses

While experiencing significant growth and widespread acceptance, CBD businesses face unique challenges when it comes to securing reliable and efficient payment solutions. The regulatory landscape, high-risk perception, and limited options pose significant hurdles for these businesses in obtaining merchant accounts from traditional financial institutions. However, specialised high-risk merchant account providers offer tailored solutions to meet the specific needs of CBD businesses.

These CBD-friendly payment and banking solutions provide a range of services, including credit and debit card processing, secure transactions, payment gateway integration, ACH processing, high volume processing, multi-currency processing, recurring billing, mobile payments, POS systems, chargeback management, fraud prevention tools, reporting and analytics, customer support, eCheck processing, and virtual terminals.

Furthermore, CBD businesses can explore alternative payment options such as cryptocurrency payments, offshore merchant accounts, and payment facilitators to overcome the challenges associated with traditional financial institutions.

When choosing a merchant account provider, CBD businesses should prioritise compliance expertise to ensure adherence to legal and regulatory frameworks. Security measures, competitive fees, and rates should also be considered to protect sensitive customer information while maintaining cost-effectiveness. By partnering with the right merchant account provider, CBD businesses can ensure seamless transactions, customer trust, and sustained growth in an industry that continues to experience increasing demand.

Navigating the financial landscape of the CBD industry doesn’t have to be daunting. At Capitalixe, we understand the unique needs of CBD and offer tailor-made payments and banking solutions so you can focus on your business. Get in touch for a complimentary consultation with our team of experts and learn how we can help your CBD enterprise succeed!