What is the future outlook for the fintech industry?

The fintech sector, a dynamic blend of finance and technology, has significantly transformed the global financial landscape over the past few decades. By offering innovative products and services, fintech companies have addressed the challenges associated with traditional financial institutions. Leveraging cutting-edge technologies and user-friendly apps, these companies have enhanced digital experiences, extended financial services to the unbanked, and streamlined operations for greater efficiency.

The COVID-19 pandemic marked a pivotal moment for fintech, catapulting it from the periphery to the centre stage of the financial services industry. The pandemic-induced shift towards digital financial services led to the mainstream acceptance of fintech, particularly in areas like payments and transaction banking. Fintech giants such as Stripe, Square, Alipay, PayPal, Nubank, and PayTM have emerged as household names, reshaping the financial landscape.

Globally, there are approximately 32,000 fintech companies, which have attracted over $500 billion in funding over the past decade. Since 2019, fintech companies have secured around 20% of global venture capital investments. These investments have not only come from financial services specialists but also from generalist investors and hedge funds with a keen interest in technology.

The crypto sub-sector of fintech has experienced a surge in funding, with over $50 billion raised in 2021 and 2022. This accounts for 75% of all crypto funding received through 2022.

Fintech companies have witnessed remarkable valuations, representing approximately 9% of the total financial services valuations worldwide in 2021. Public valuations reached an impressive $1.3 trillion, with a multiple of 20 times annual revenue compared to the historical multiple of six times before 2018. Mega-fintechs like PayPal and Ant Financial even ranked among the top-10 financial services companies globally by market capitalisation in 2021.

2022 Reality Check for Fintech

Over the past year, the fintech industry has experienced a humbling journey.

Starting in April 2022, the once exuberant fintech sector faced a harsh reality as valuations took a significant hit across all segments and regions, plunging by an average of over 60%. However, amidst these challenges, revenue growth managed to persist, albeit at a slower pace.

One notable change has been the decline in global fintech funding, which has dropped by 43%. While early-stage companies still attracted venture capital investments, later-stage companies faced substantial decreases in funding rounds. Among the most severely affected were Series C+ companies, who encountered the greatest obstacles during this period.

These shifts in the fintech landscape can be attributed to rising interest rates, which have increased the cost of capital and put an end to the era of zero-priced funding. The rise in interest rates is a result of persistent inflation, triggered by a range of factors including geopolitical tensions, supply-chain disruptions, and the ongoing recovery from the pandemic.

Both fintechs and investors have felt the impact of these changes in the financial landscape.

Emerging Fintech Technologies

Financial services stand out as one of the most lucrative sectors within the global economy.

Despite currently contributing less than 2% to global financial services revenues, fintech is poised for significant growth, especially in the digital banking space. As of now, digital usage in banking stands at 39%, a figure that dips to 17% in regions like the Middle East and Africa. This disparity highlights the vast room for expansion and the untapped potential in these markets.

The fintech sector has undergone a remarkable evolution, progressing through four distinct phases on technological innovation that revolutionised the financial services landscape.

Digital Disruption

1998 to 2008: Digital disruption took center stage as fintech companies challenged traditional financial institutions with online banking, lending, and e-commerce innovations.

Mobile and Social Adoption

2009 to 2014: We witnessed the widespread adoption of mobile and cloud technologies, empowering consumers to access real-time financial services. Fintech companies focused on enhancing user experience and leveraging social media and data analytics for personalised solutions.

Relevance and Scale

2015 to 2021: The industry experienced significant growth, fueled by smartphone adoption and exemplified by household names such as Ant Financial, Nubank, PayTM, Square, and Stripe. These companies expanded access to financial services and reduced costs for customers.

Convergence and Financial Inclusion

2022 and beyond: The fintech sector is poised for further growth and innovation. With a proactive regulatory environment, infrastructure investments, and technological disruptions like generative AI and Distributed Ledger Technology (DLT), the future of fintech promises to be transformative.

The fintech sector is continuously evolving, driven by the rapid advancements in technology. As we navigate the future of fintech, several key technologies are set to shape the industry:

- Generative AI is revolutionising the human-digital interface with its natural-language based capabilities. This technology not only enhances customer service but also helps incumbents overcome their technical constraints. In the future, generative AI will facilitate digital financial concierges, completing tasks such as bill payments, budget checks, and dispute resolutions, thereby reducing the need for human interaction.

- Open Banking 2.0, or API-Based Open Connectivity, is set to standardise interfaces for banks, corporates, and governments. This technology enables seamless access to customer data and advanced financial services, fostering global collaboration between financial institutions. APIs can also gather data from various unrelated sources to create highly accurate risk assessments for credit underwriting, fraud detection, and more.

- Distributed Ledger Technology (DLT) offers a global blockchain-based infrastructure for a worldwide transactional and settlement platform. DLT supports the creation of a decentralised supply chain platform, enabling businesses to obtain financing more efficiently. This technology also facilitates the tokenization of complex, real asset classes and the execution of smart contracts.

- Quantum and Edge Computing provide unprecedented power and speed for solving complex problems. These technologies can benefit various areas of finance, including portfolio selection, asset allocation, and overall business optimisation programs. Quantum computing can also develop next-gen encryption and financial cybersecurity technologies.

- Embedded-Hardware IoT and Biometrics can be used to develop highly personalised financial products. IoT devices can trigger automatic financial transactions, which can be especially practical if combined with smart contracts. Advanced smartwatches can monitor health statistics, with the resulting behavioral changes by users leveraged to tailor health insurance policies down to the risk of specific diseases.

Fintech Revenue Growth

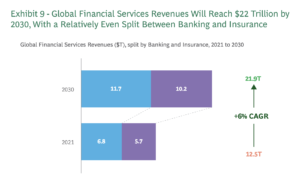

The global financial services industry, currently valued at $12.5 trillion, is predominantly concentrated in North America and the Asia-Pacific region, with banking and insurance holding an equal share. By 2030, the global banking and insurance revenue pools are projected to reach $21.9 trillion, marking a 6% compound annual growth rate (CAGR).

Payments and deposits are anticipated to be the fastest-growing segments in the industry. The most significant expansion is expected in the Asia-Pacific and Latin America regions. Fintechs are predicted to play a crucial role in this growth, with their annual revenues projected to increase more than sixfold from 2021 to 2030, reaching $1.5 trillion.

Banking fintechs, specialising in lending, deposits, payments, and trading and investments, are projected to grow from 4% to 13% penetration of banking revenue pools by 2030. They are expected to represent one-fourth of global banking valuations. Insuretechs, on the other hand, are projected to grow from a 0.3% to 2% market penetration of insurance revenue pools.

The shape of this expansion will vary by geography and segment. However, it’s clear that the future of the global financial services industry is bright, with fintechs playing a significant role in shaping its trajectory.

Regional Fintech Outlook

The fintech journey varies across regions, influenced by factors such as funding availability, talent pool, regulatory stance, and technology adoption. APAC, with its strong incumbents and large revenue pools, is poised for significant growth.

Asia-Pacific: The Epicentre of Growth

The APAC region projected to outshine all others and become the world’s largest fintech market by 2030. This growth is primarily driven by the unique blend of factors shaping the fintech space in this region, and local champions solving access issues and facilitating financial inclusion.

Growth in APAC is expected to be spearheaded by emerging countries like China, India, and Indonesia. These countries boast the largest fintechs, voluminous underbanked populations, a high number of SMEs, and a rising tech-savvy youth and middle class.

This region, historically underpenetrated, is set to experience a compound annual growth rate (CAGR) of 27%.

North America: A Fintech Innovation Hub

With a mature innovation ecosystem, including venture capital firms, entrepreneurs, talent pools, universities, and access to funding, North America is a critical fintech market and innovation hub.

The growth in North America’s fintech sector is expected to be fueled by the proliferation of B2B2X (business-to-business-to-everything) and B2B businesses, the expansion of monoline fintechs into additional products and services, and the country’s interchange pool.

Despite having the most mature ecosystem, the US is yet to fully embrace open banking, leaving room for significant innovation in the financial services industry.

The US is projected to account for 32% of global fintech revenue growth through 2030, a compound annual growth rate (CAGR) of 17%.

Europe: Fintech’s Rising Star

Europe, represented by the UK and the European Union, is the world’s third-largest financial market and is expected to witness major fintech growth through 2030.

This growth, estimated at more than fivefold over 2021, is expected to be led by the payments sector. With forward-looking regulators and a fintech penetration of just 1% of financial services revenues, Europe is poised for significant fintech expansion.

The region’s fintech sector is projected to post a revenue CAGR of 21% leading up to 2030.

Latin America: Accelerated Fintech Penetration

Fintech growth in Latin America is led by Brazil and Mexico. These countries have attracted institutional investors and witnessed rising adoption of advanced technologies across industries.

The local fintech ecosystem is being built up by native professionals returning home after gaining experience abroad. Government initiatives facilitating fast retail payment systems and digitisation continue to support this growth.

The region is projected to show a revenue compound annual growth rate (CAGR) of 29% over the coming years.

Africa: Leapfrogging with Fintech

In Africa, fintech could be a vehicle to solve the access issue, as most of the population is still either underserved by banks or fully unbanked.

As the youngest and fastest-growing region globally—with a median age of roughly 19 and projected population growth of an additional 1.2 billion people by 2050—demographic shifts and earning-power increases will deepen the need for financial access.

Some degree of leapfrogging in technology is expected, particularly when it comes to cashless payments.

Project of fintech revenue are estimated at a CAGR of 32% until 2030, with South Africa, Nigeria, Egypt, and Kenya being the key markets.

Transforming the Payments Landscape

The fintech journey has been largely driven by payments, accounting for 40% of all fintech revenue in 2021. This sector, with a significant potential for growth, is expected to remain the largest fintech segment in 2030.

The fintech revolution in payments is reshaping the financial industry, introducing innovative solutions that enhance efficiency, security, and accessibility. This revolution is particularly evident in cross-border payments, real-time transactions, and the Payment-Plus model.

Cross-Border Payments: Fintech’s Global Impact

Cross-border payments, a market dealing with over $20 trillion annually, have been revolutionised by fintech. Traditional systems like SWIFT and Visa/Mastercard, while reliable, are being challenged by fintech companies such as Remitly, Wise, and Xoom. These innovators are reducing costs, enhancing security, and expanding access to international money transfers. Blockchain companies like Ripple are also making strides, partnering with financial institutions worldwide to facilitate real-time, cross-border payments.

Real-Time Payments: The New Normal

Real-time payments (RTPs), which credit transfers within seconds, are another area where fintech is making waves. The use of RTPs surged by 42% in the US in 2020, a trend expected to continue with the development of instant payment services like FedNow by the Federal Reserve. Similar platforms are being implemented globally, indicating a shift towards faster, cheaper, and more secure transactions.

Payment-Plus: The Fintech Flywheel

In the Payment-Plus model, payment processors leverage two-sided marketplaces to deliver a flywheel effect, offering omnichannel services. This model enables payments companies to offer additional services such as billing, invoicing, tax automation, and Banking as a Service (BaaS), creating a mini-superapp ecosystem of financial services.

Embedded Finance and Financial Infrastructure

Embedded finance is set to see promising new use cases in industries such as transportation and healthcare, with fintechs playing a crucial role. Infrastructure “as-a-service” companies will become more prominent, enabling a variety of use cases among both fintechs and incumbents.

The fintech revolution in payments is transforming the financial landscape, offering faster, cheaper, and more secure transactions. As we move forward, the role of fintech in shaping the future of payments will only become more significant.

B2B2X: Powering Future Growth

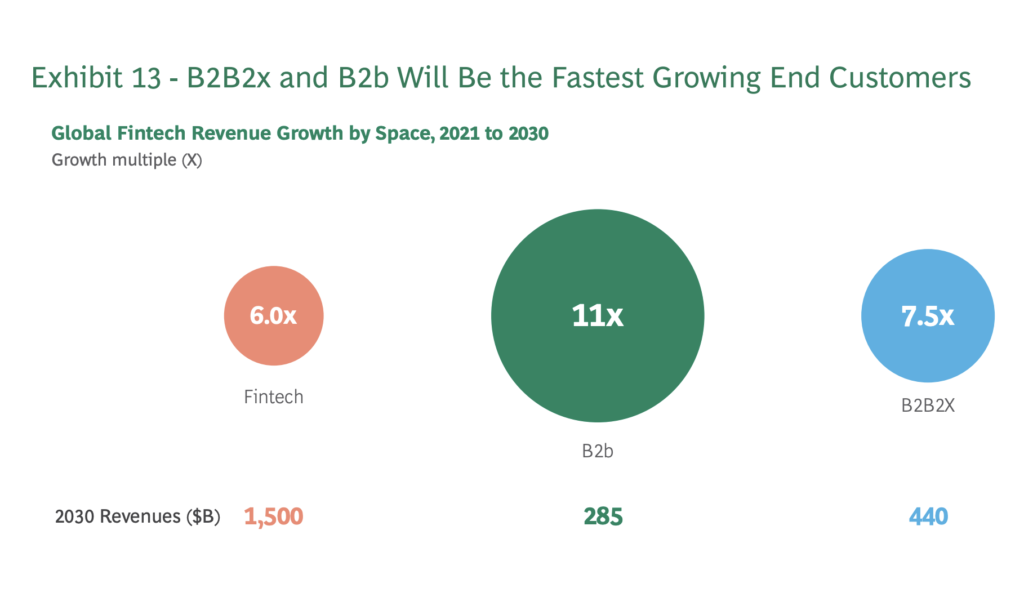

B2B2X, comprising B2B2C, B2B2B, and financial infrastructure players, is expected to power the next phase of growth. With many banks struggling to innovate due to legacy processes and systems, fintechs have an opportunity to fill the gap and enable incumbents to compete more efficiently.

The B2B2X market is expected to grow at a 25% CAGR to reach $440 billion in annual revenues by 2030.

Reinventing Value Chains and B2B Space

The fintech disruption in value chains and B2B is transforming the financial landscape, particularly in the mortgage industry and the SME sector. This disruption is transforming the financial landscape, offering faster, cheaper, and more secure transactions. As we move forward, the role of fintech in shaping the future of payments will only become more significant.

Fintechs are becoming embedded “as-a-service” within independent software vendors (ISVs), addressing the needs of a particular industry, customer type, or use case. The goal for fintechs is to become vertical champions, utilising additional distribution channels, opening new revenue streams, and providing end-to-end customer journeys.

Mortgage-tech: Disrupting Value Chains

Mortgage-tech companies are a prime example of fintech’s disruption in value chains. Despite improvements in customer and employee experiences in the mortgage-origination process, the cost per loan and the cycle time from application to close have remained stagnant. However, emerging companies like TrustEngine, Indecomm, Valligent, and Brace are tackling these friction points, aiming to reduce costs, automate decision-making, and diversify revenue sources.

B2B Fintech: The Next Massive Disruption

The B2B segment of fintech, catering to SMEs, represents a massive opportunity for growth. SMEs, accounting for close to 70% of jobs and GDP globally, are often underserved and credit starved. B2B fintech revenues are projected to grow at a 32% CAGR to become a $285 billion market by 2030. Fintechs have a vast potential with SMEs, especially in areas such as payments and lending, with the unmet financial credit needs for the world’s SMEs totaling over $5 trillion annually.

Spread Businesses: The Need for Banking Licenses

Spread businesses, including banks, neobanks, lending platforms, and credit unions, profit from the difference between the fees or interest charged for financial products and the cost of enabling the transaction. The spread size varies based on market conditions, a borrower’s creditworthiness, and the type of financial product or loan offered.

Neobanks

Neobanks in developed markets face several challenges in scaling up profitably. One significant challenge is the narrowing gap in customer experience between themselves and incumbent banks, as the latter are investing heavily in technology to improve their customer experience and value chains, making it difficult for neobanks to differentiate themselves.

Another challenge is that neobanks typically attract lower-LTV customers with their “no fees” or “lower fees” value propositions, which are harder to monetise and require a significant volume of transactions and customers in order to generate profits.

Neobanks will fare much better in emerging markets, as these businesses play a key role in expanding financial access. There are roughly 2.8 billion underbanked adults in the world, and an additional 1.5 billion are unbanked, with the majority residing in emerging economies.

To build a sustainable and profitable business model, neobanks will eventually need to begin lending on their own balance sheets to earn additional interest income and generate reasonable profits. One pathway, as neobanks such as SoFi have found, is to acquire a banking license and, with it, a complete balance sheet.

Lending Platforms

Like neobanks, lending platforms will need to transition towards obtaining banking licenses.

Lending platforms such as BNPL, student lending, and unsecured lending have performed well in recent years, thanks to near-zero interest rates. These platforms typically fund themselves through securitisation of assets or issuing commercial paper. However, with rising interest rates, securing funding has become increasingly expensive, making this business model unsustainable. One solution for these lending platforms to secure a reliable source of low-cost funding is to own or acquire a banking license.

Insuretech and Wealthtech: A New Era of Growth

The global insurance industry, a colossal entity with a revenue of $7 trillion in 2021, is on a trajectory to reach $11.6 trillion by 2030. Yet, the fintech penetration in this vast market, known as “insuretech,” is a mere 0.3%. The most significant opportunities lie in the property and casualty (P&C) insurance sector, a key area for fintechs due to its high frequency of policies and shorter purchase durations.

However, the complexity of the insurance industry, coupled with varying regulatory landscapes, poses a challenge for full-stack disrupter models. Despite these hurdles, insuretech revenues are projected to grow at a 27% CAGR, hitting $200 billion by 2030.

The Insuretech Landscape

The largest window of opportunity within insurance is P&C. These products, often purchased by individuals, have a higher policy frequency and shorter purchase duration, making them attractive for fintechs. Conversely, life insurance, with its long durations, and health insurance, typically employer-purchased, are more challenging to penetrate.

The insurance industry’s complexity and high regulatory granularity make it difficult for disrupters to scale. However, the rise of tech-led disrupters is not entirely off the table. The most significant opportunities lie in tech enablement of human processes, IoT, and AI for better underwriting, claims, and distribution through brokerages.

Wealthtech: Democratising Investments

Wealthtech innovation began with robo-advisors targeting mass-market segments, democratising investing for consumers previously underserved by incumbents. However, the addressable market for wealthtech disrupters is limited, primarily catering to the mass-market segment.

Moving up the value chain to the mass-affluent space is a possibility, but it is still a small market. Most global wealth is concentrated in high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals and organisations. These segments are heavily dependent on human trust and advice, making them challenging to access through traditional customer acquisition methods.

In the face of these challenges, the future of insuretech and wealthtech remains promising. The industry’s growth is driven by the rise of innovative, comprehensive, technical, or analytical tools that serve scaled businesses catering to mass-affluent segments. As the industry continues to evolve, the opportunities for growth and innovation in the insuretech and wealthtech sectors are boundless.

Fintech Growth and Risks: A Call for Action

The fintech industry, while promising, is fraught with significant challenges. These include regulatory uncertainties, data privacy concerns, competition from big tech, and interest-rate volatility. The absence of comprehensive regulation in the fintech industry can lead to trust issues among customers, potentially resulting in a low adoption rate for fintech solutions.

Despite these hurdles, the sector’s future remains bright, provided stakeholders collaborate effectively for the greater good.

Regulatory Challenges in Fintech

The fintech industry’s growth has been somewhat hampered by a lack of comprehensive regulation. This has led to trust issues among customers, resulting in a slower adoption rate for fintech solutions. For instance, the cryptocurrency exchange FTX’s fall due to liquidity issues and mismanagement of funds, largely unregulated, has had far-reaching consequences for the crypto industry.

However, potential regulatory overreach can also stifle growth and innovation. Rigid regulations can lead to higher costs, slower approvals, and reduced investment. The European Union’s MiFID II directives, intended to improve transparency and accountability, have been criticised as overly burdensome, particularly for smaller financial firms.

Data Privacy and Reputational Risks

Fintech companies face significant reputational risks, especially those related to data breaches and the mishandling of sensitive data. Companies that collect large amounts of sensitive data in an unregulated manner are at a higher risk of data breaches, which can result in severe and long-lasting reputational harm, loss of customer trust and loyalty, and potential legal consequences.

Big Tech Competition and Interest-Rate Volatility

The entry of big-tech companies into the fintech industry can drive prices down and eliminate competition, creating a monopolistic environment that negatively impacts smaller fintech startups, overall innovation, and consumers. This dynamic, combined with a higher interest rate environment that can pressure funding and stifle innovation, presents a tall set of challenges for fintech startups.

The Path Toward Growth: Collaboration is Key

The future of fintech lies in partnerships and collaboration. The growth and success of the sector will largely depend on how four key stakeholders – regulators, fintech companies, incumbents, and investors – work together for the long-term benefit of the global financial services sector and its customers.

- Regulators need to be proactive and thoughtful, acting with urgency to create a more holistic regulatory framework. They need to lead from the front, developing and enforcing policies that protect consumers but do not stifle innovation.

- Fintechs need to focus on their core business, conserve cash, and embrace regulation. They should prioritise Compliance by Design internally to prepare for successful partnerships with established financial institutions.

- Incumbents should accelerate their digital journeys by embracing fintechs. This can serve as a win-win, effectively shortening their time and cost to market.

- Investors should play long, supporting existing investments with clear product-market fits and helping their portfolio companies become more professionalised.

As the industry continues to grow and evolve, the ability to form and maintain successful partnerships will determine the success of fintech companies. Whether it’s to enhance existing products, acquire new customers, or innovate new products, partnerships are the key to achieving these goals.

While the fintech industry faces significant challenges, its future is bright. By working together, stakeholders can navigate these challenges and foster growth and innovation in the sector.

Embracing the Future

The future of fintech, as illuminated by this comprehensive BCG report, is a vibrant tapestry of innovation, growth, and transformative potential. The sector, having evolved from a peripheral player to a central force in the global financial landscape, is poised to continue its trajectory of disruption and advancement.

Emerging technologies such as Generative AI, Open Banking, Distributed Ledger Technology, and Quantum Computing are set to further revolutionize the industry, offering unprecedented opportunities for efficiency, accessibility, and personalization. However, the journey ahead is not without challenges.

Regulatory uncertainties, data privacy concerns, competition from big tech, and interest-rate volatility pose significant hurdles. Yet, the sector’s resilience and adaptability, coupled with the collaborative efforts of regulators, fintech companies, incumbents, and investors, promise a bright future.

The fintech revolution is just beginning, and its impact on the global financial services industry is set to be profound and far-reaching.

As we navigate the exciting fintech landscape, it’s Capitalixe‘s mission to guide you through the complexities of the industry and help you find the best payments and banking solutions for your business. If you’re looking to ride the fintech growth wave, our team of expert consultants is here to help you succeed. Get in touch!